10 tips for the correct application of the PTE!

10 tips on how to correctly apply the withholding tax reduction for R&D: Define the R&D paths in a roadmap. Identify R&D activities and record

In 2003, Belgium introduced the program of partial exemption from payment of withholding tax for organizations employing researchers.

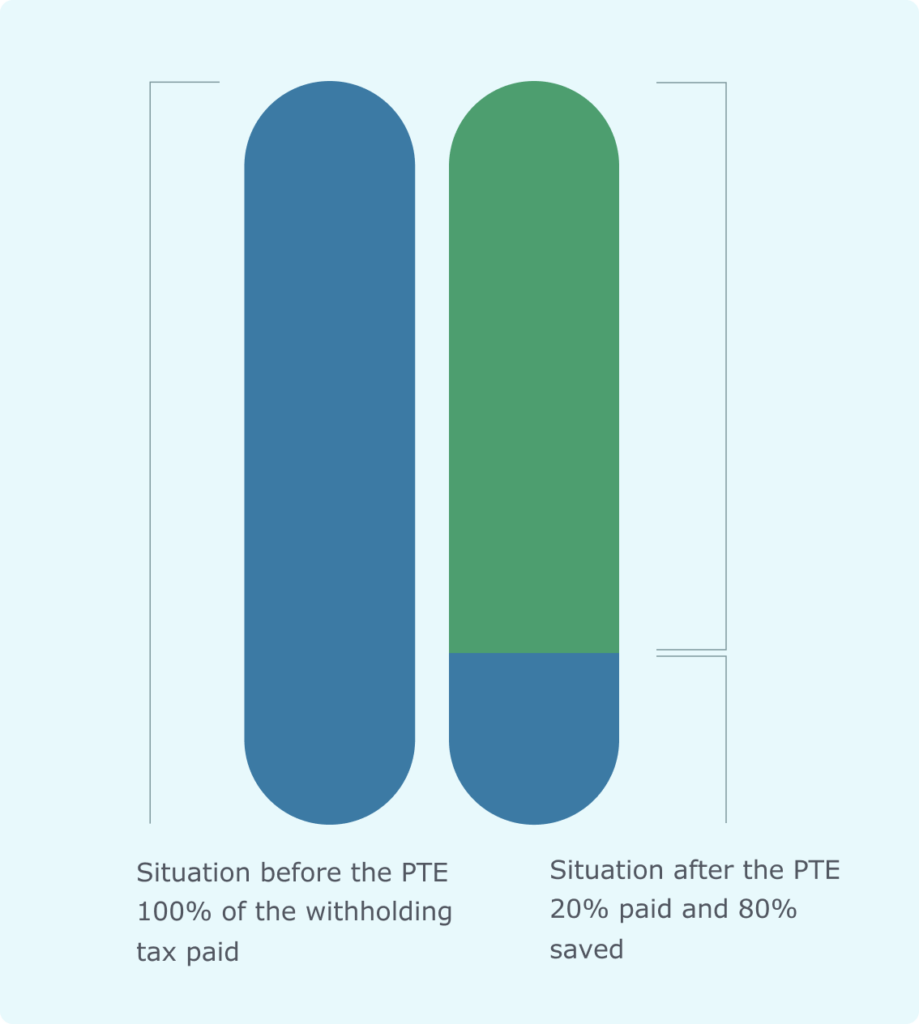

This measure allows companies not to pay the tax authorities up to 80% of the withholding tax on the salaries of staff working on innovative and R&D projects. The definition of R&D is based on the Frascati Manual and includes basic research, industrial research and experimental development.

On average €10,000 in savings per year per employee 100% dedicated to R&D .

Also applicable to IT development.

Compatible with all benefits (including copyright).

Immediately realizable savings, regardless of your taxable base.

Possibility of recovering the unduly paid withholding tax on the last 4 financial years closed.

Thanks to artificial intelligence tools, MoneyOak offers you the possibility to confirm your eligibility and estimate your savings for free.

10 tips on how to correctly apply the withholding tax reduction for R&D: Define the R&D paths in a roadmap. Identify R&D activities and record

Born at the beginning of 2000, this tax mechanism is one of the most popular with companies. The principle? To create the conditions for your

In recent years, the legislator has extended the scope of the PTE to “all” companies employing researchers (although there is no definition or degree requirement

MoneyOak helps you to grow and develop. To highlight what makes your company stand out. To invest in the future.

Avenue Louise 523

1050 Brussels

+32 2 318 67 13

hello@moneyoak.be