Do you have a patent or a computer program protected by copyright? If so, you can benefit from a very interesting Belgian tax measure: the Innovation Income Deduction.

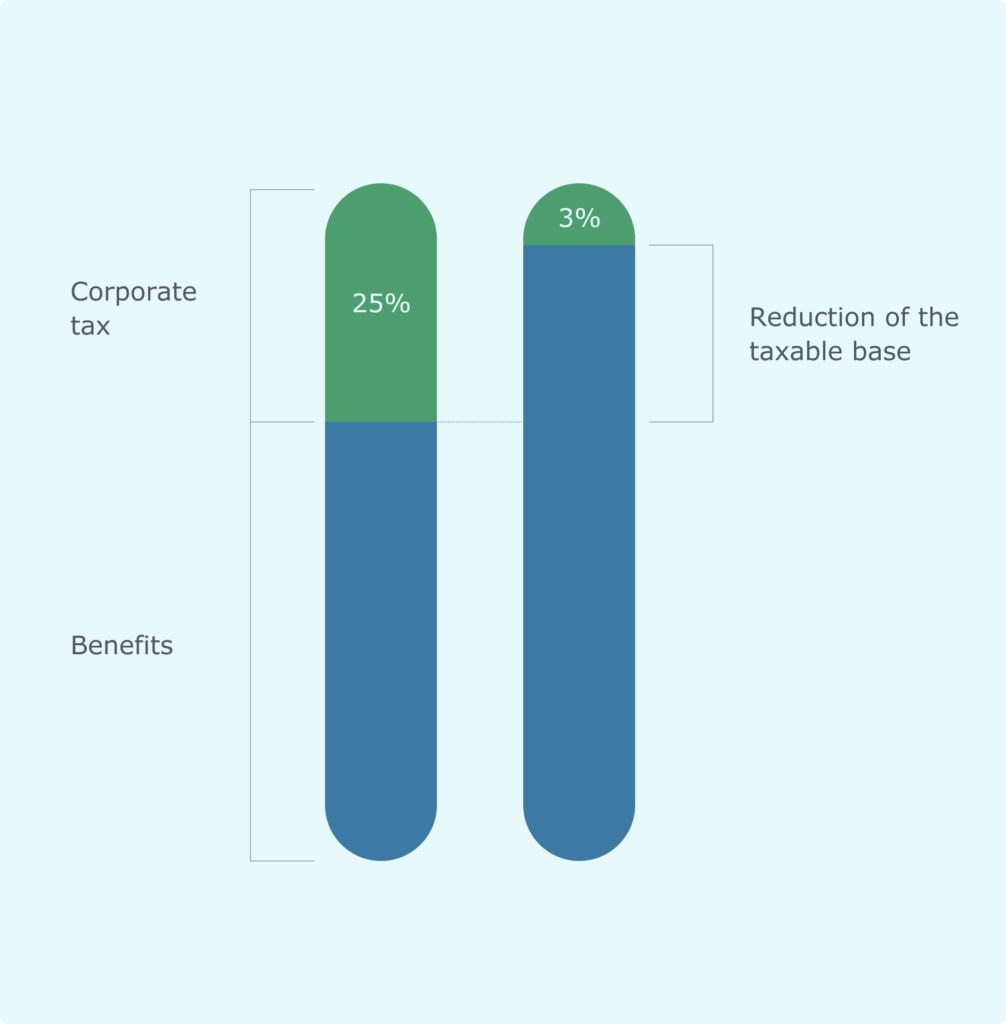

In 2017, Belgium replaced the Patent Income Deduction (PID) with the Innovation Income Deduction (IID). A major change in this measure is the inclusion of innovative computer programs protected by copyright. The IID reduces the taxable base for corporate income tax. The amount can be up to 85% of the net income attributable to eligible intellectual rights, including patents or software that are protected by copyright. MoneyOak reviews and confirms the eligibility of these intellectual rights.

Income deductible at 85% of your taxable base.

Also applicable for your software.

Compatible with all benefits (withholding tax exemption, subsidies).

Savings net of tax.

Can be secured by a tax ruling.

Thanks to our artificial intelligence technology, MoneyOak allows you to check your eligibility for the IID.

The IID is a deduction, the burden of proof lies with the taxpayer. Therefore, the importance of a comprehensive scientific and tax report is obvious…

This correction factor is intended to ensure that the R&D efforts are carried out by the taxpayer or by independent contractors on behalf of the