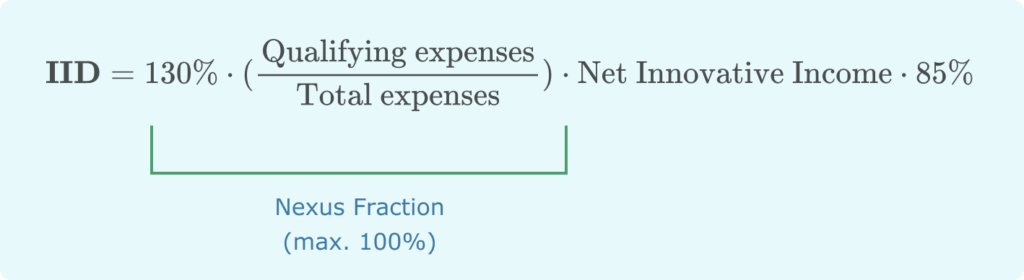

This correction factor is intended to ensure that the R&D efforts are carried out by the taxpayer or by independent contractors on behalf of the taxpayer. It is appropriate to penalize acquisition costs and R&D expenditure outsourced within a company-related entity. These “non-qualifying” costs, introduced in the nexus ratio, weigh on the balance to reduce the tax benefit. In contrast, “qualifying” expenses are internal R&D costs or those subcontracted to a non-related company. Among other subtleties, such as a 30% uplift, it should be noted that the nexus ratio is a rebuttable presumption: this means that its application can be challenged when the deduction is too low.